Programme Risk Day 2022

Friday, 16 September 2022

ETH Zurich, main building, Rämistrasse 101, auditorium HG E7

Time | Speaker | Talk |

|---|---|---|

| 14:00 - 14:45 | external page Montserrat Guillen Universitat de Barcelona | Motor insurance with telematics driving data |

| 14:45 - 15:30 | external page Michael Mayer Mobiliar | Partly additive models: a trade-off between linear models and the ML black box |

| 15:30 - 15:50 | Coffee break | |

| 15:50 - 16:35 | external page Silvan Andermatt Swiss Finance and Technology Association | Digital assets – an evolution with challenges and risks |

| 16:35 - 17:20 | external page Mathias Studach SIX Digital Exchange | Distributed ledger technology and digital assets - myth or fact? |

| 17:20 - 17:40 | Coffee break | |

| 17:40 - 18:25 | external page Daniel Egger IBM Research | Quantum computing and its applications to financial services |

| 18:30 - 19:30 | Apéritif |

Abstracts

Montserrat Guillen

Motor insurance with telematics driving data

Many insurance companies collect telematics data about drivers’ exposure to traffic (distance driven and type of road), their driving behavior (excess speed, aggressiveness, operating hours) and contextual information (weather conditions, traffic intensity). Actuaries use this information to improve motor insurance ratemaking. Several recent proposals will be presented, mostly using traditional GLM models. In addition, personalized driving risk indicators can also promote driving safety. Illustrations with several real data sets provided by insurance companies will answer questions: (1) How are pay-per-mile insurance schemes be designed? (2) How can near-miss telematics be used to identify risky drivers? (3) What is the power of risk analytics and percentile charts to monitor drivers?

Michael Mayer

Partly additive models: a trade-off between linear models and the ML black box

As a trade-off between linear models and the machine learning (ML) black box, Michael explains how ML models can be adapted so that some covariates are modeled additively for maximal interpretability, while groups of other covariates are allowed to interact in a complex way for maximal predictive performance. The idea is illustrated with an actuarial use case in non-life motor insurance pricing.

Silvan Andermatt

Digital assets – an evolution with challenges and risks

Digital assets based on Distributed Ledger Technology (DLT) / Blockchain became increasingly popular with the adoption of cryptocurrencies such as Bitcoin. Many hoped that stablecoins would mitigate some issues of cryptocurrencies, but stablecoins not always did. Ultimately, Central Bank Digital Currencies (CBDC) seem the natural evolution of fiat money, although concerns are raised around the world. Silvan guides you through the developments in digital assets, from the origin to present, with an overview of current challenges and risks and an outlook into the metaverse and the future of digital assets.

Mathias Studach

Distributed ledger technology and digital assets - myth or fact?

Distributed ledger technology claims to solve a wide range of problems and is often presented as the technology that will revolutionize the way assets are safekept and exchanged. However - besides the rise and retail adoption of crypto-assets, the financial industry has so far not been able to exploit the promised benefits of the new technology. We provide insights from the world’s first DLT-enabled digital exchange (SIX Digital Exchange) on what the real benefits of such technologies are, which challenges we needed to overcome, and what challenges remain to leverage their full future potential.

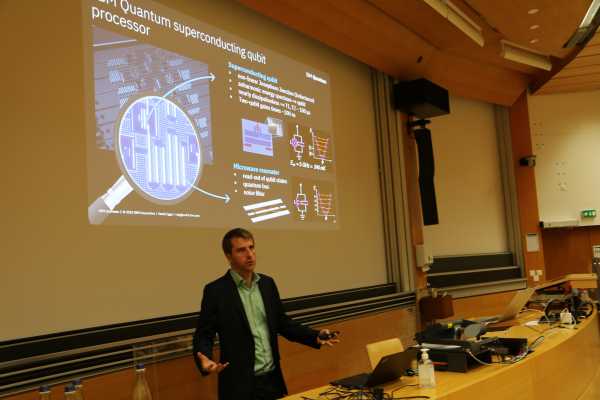

Daniel Egger

Quantum computing and its applications to financial services

Quantum computers process information using the laws of quantum mechanics. This novel computing paradigm is expected to solve complex problems in optimization, machine learning, and simulation. In this talk we will briefly introduce quantum computing and the IBM quantum hardware and software development roadmap. Next, we will focus on the applications of quantum computing to the financial services sector. This includes combinatorial optimization and how to replace Monte Carlo simulations with Quantum Amplitude Estimation to evaluate, e.g., risk metrics such as VaR and CVaR with a quadratic speed-up.