Past lectures

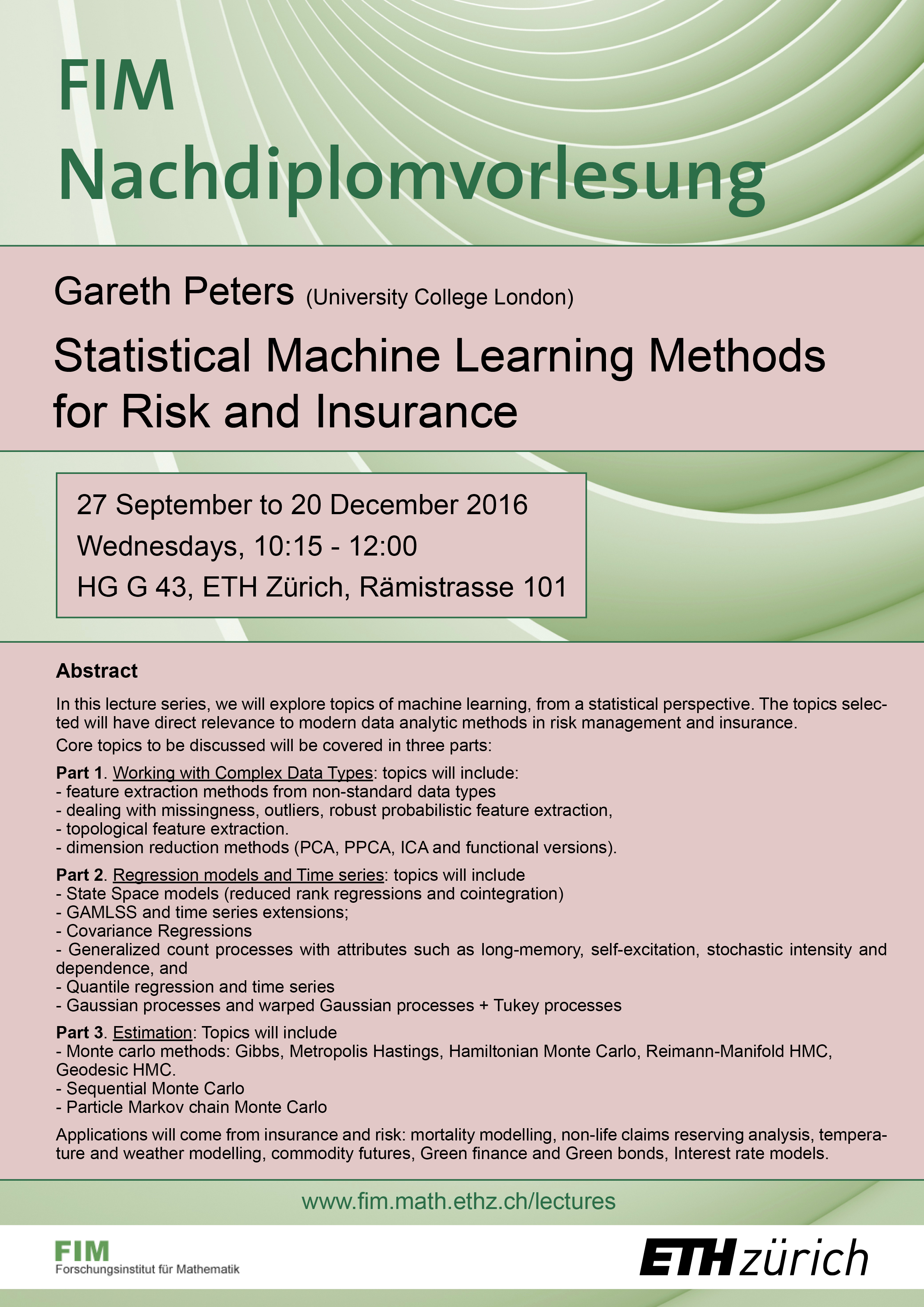

Statistical Machine Learning Methods for Risk and Insurance

Prof. Dr.

Gareth

Peters

University College London

September 27 -

December 20, 2017

Date and time: Wednesdays, 10:15 - 12:00

Location: HG G G 43

Abstract

In this lecture series, we will explore topics of machine learning, from a statistical perspective. The topics selected will have direct relevance to modern data analytic methods in risk management and insurance.

Core topics to be discussed will be covered in three parts:

Part 1. Working with Complex Data Types: topics will include:

- feature extraction methods from non-standard data types

- dealing with missingness, outliers, robust probabilistic feature extraction,

- topological feature extraction.

- dimension reduction methods (PCA, PPCA, ICA and functional versions).

Part 2. Regression models and Time series: topics will include

- State Space models (reduced rank regressions and cointegration)

- GAMLSS and time series extensions;

- Covariance Regressions

- Generalized count processes with attributes such as long-memory, self-excitation, stochastic intensity and dependence, and

- Quantile regression and time series

- Gaussian processes and warped Gaussian processes + Tukey processes

Part 3. Estimation: Topics will include

- Monte carlo methods: Gibbs, Metropolis Hastings, Hamiltonian Monte Carlo, Reimann-Manifold HMC,

Geodesic HMC.

- Sequential Monte Carlo

- Particle Markov chain Monte Carlo

Applications will come from insurance and risk: mortality modelling, non-life claims reserving analysis, temperature and weather modelling, commodity futures, Green finance and Green bonds, Interest rate models.